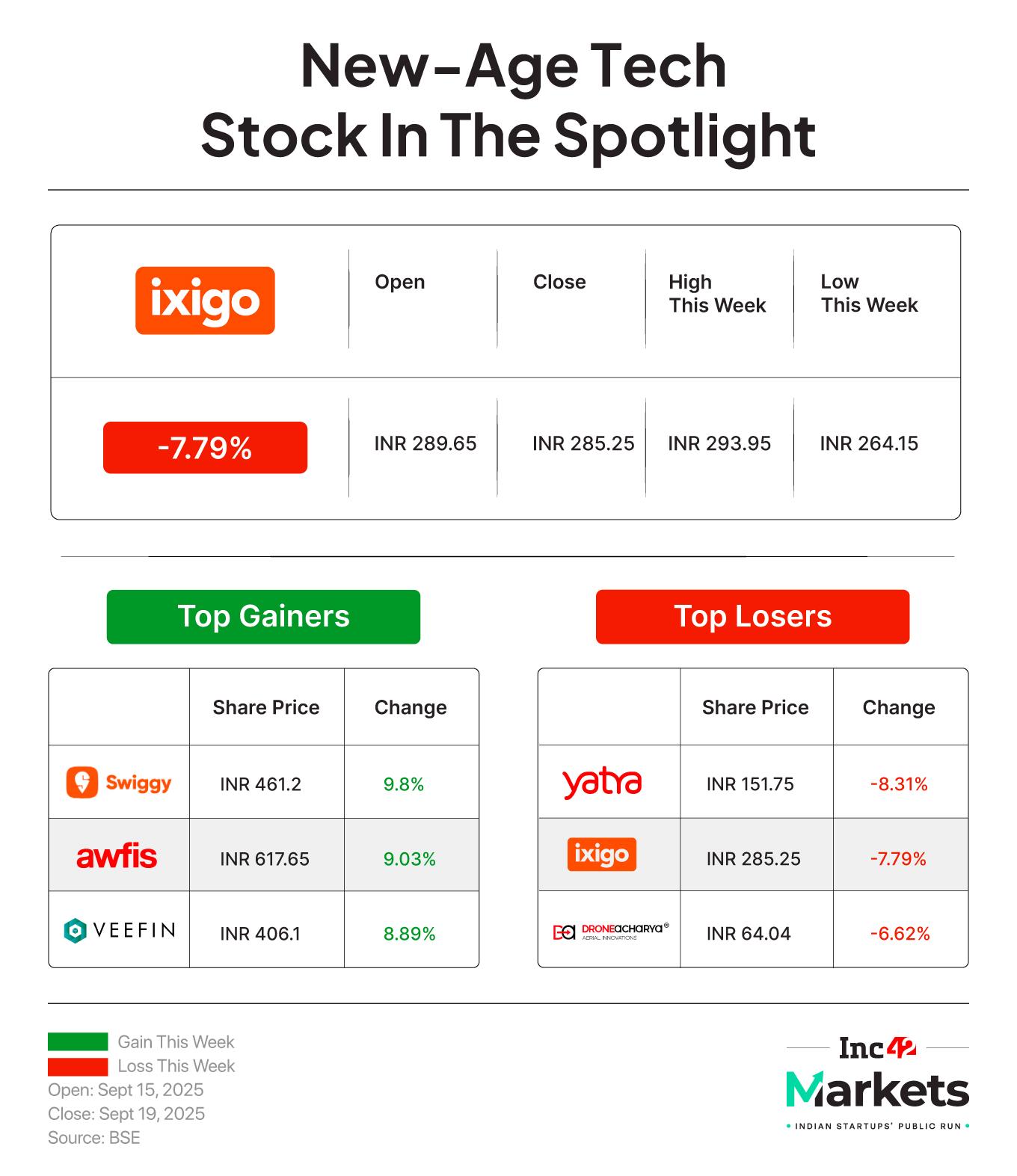

Yet another app, a host of promises, and a whole new catchline. The result is a 9.8% sprint in Swiggy shares this week.

The food delivery giant has come up with a “pinky promise” to deliver “affordable” meal options with its Toing app, which seems to be clearly targeted towards Gen Z and young working professionals.

Its pitch about “honest” prices and “dependable delivery” via Toing is currently available in Pune only, but it raises a few familiar and fundamental questions.

What about the promises of honest pricing for those ordering from the mother app where increasingly steeper fees are leaving consumers in the red? And how many more apps are in Swiggy’s pipeline as Zomato’s biggest rival goes aggressive with its unbundling playbook?

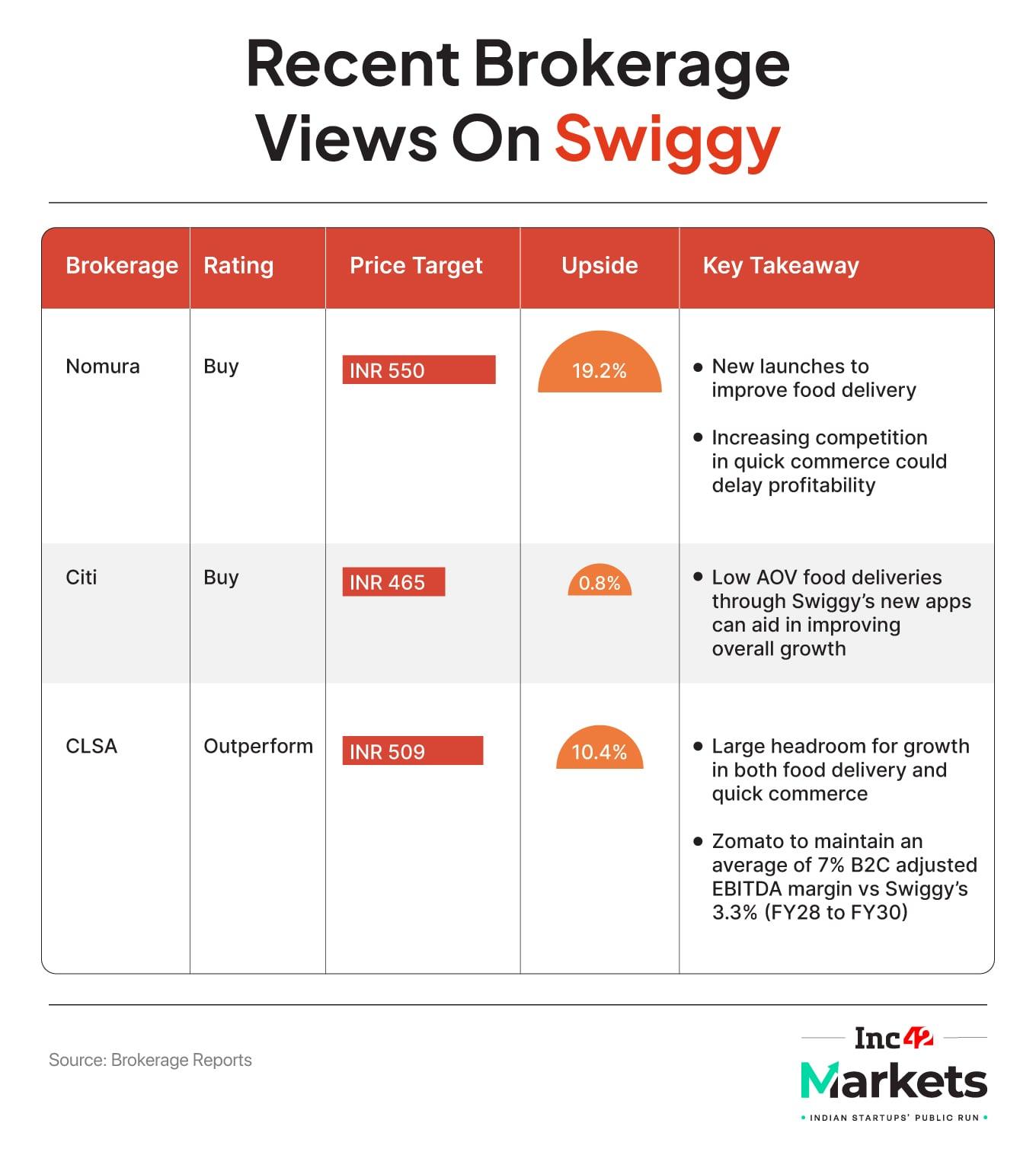

Though the stock market has greeted Swiggy with a positive response, analysts have thrown up a mixed bag.

The verdict is that this is just a frequency boosting play, which might capture more customers but will hurt Swiggy’s bottom line, reiterating that the path to profitability will be the ultimate driver of value on the bourses in the long run.

It is pertinent to note that Swiggy shares saw a sharp decline since the beginning of the year, a few weeks after its listing, amid widening losses. But from June onward, the stock staged a recovery — climbing more than 38% in just four months, with this week’s close of INR 461.2 hovering at a level last seen on January 23.

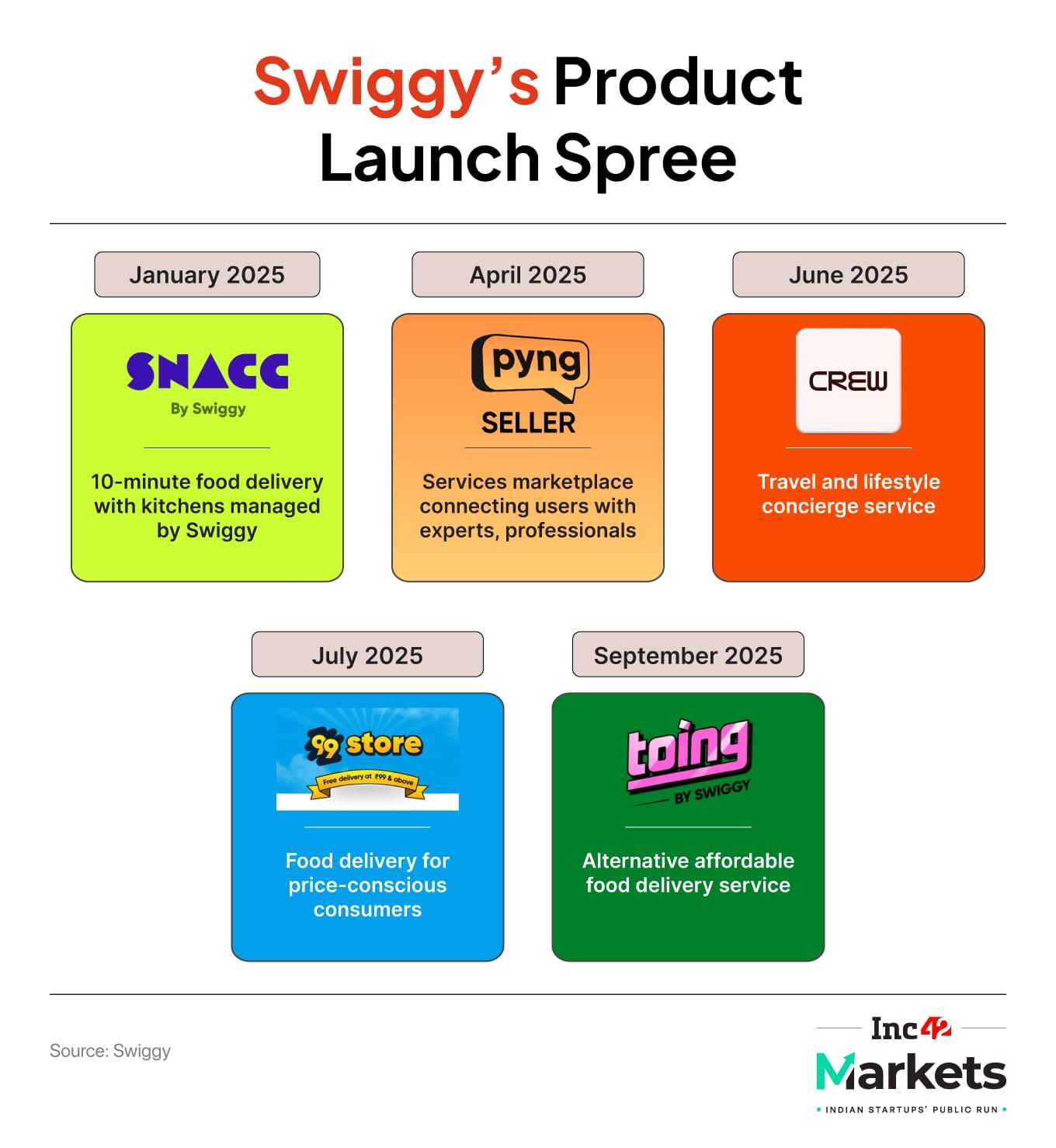

So, even as the fundamentals remained weak, a mix of small triggers seems to have fuelled the rally — from new product launches and the shutdown of older bets to big brokerages turning bullish on the company’s quick commerce play.

Most recently, in July, the company posted its Q1 FY26 results, which further triggered the stock to rise after a few sessions of decline. The reason? While Swiggy doesn’t seem to be on a trajectory to turn around its losses, at least the margins are improving.

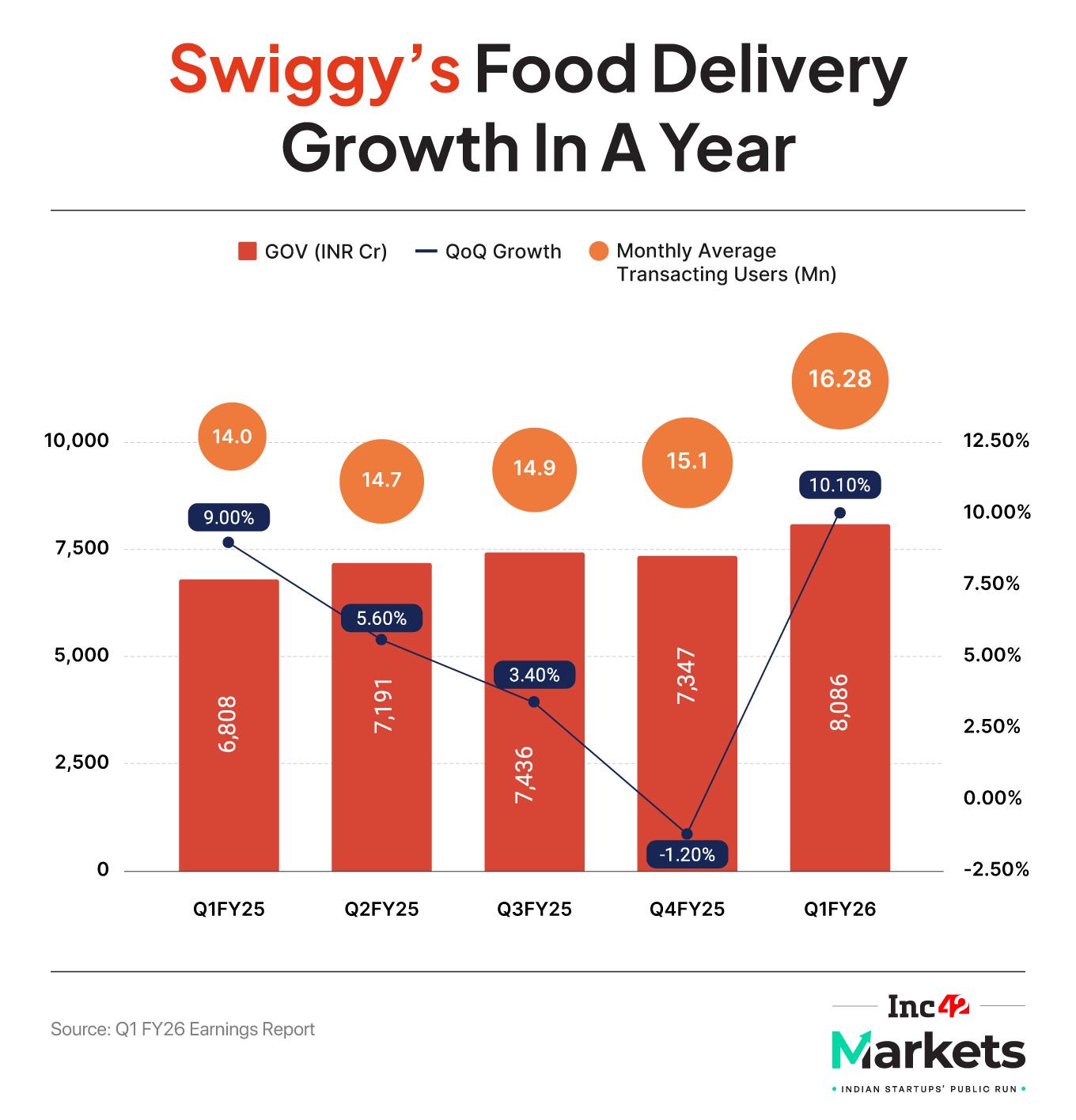

Compared to the last few quarters’ bleak growth rate in food delivery gross order value (GOV), the company posted a 10.1% sequential rise in the metric to INR 8,086 Cr in the June quarter.

Can this growth be attributed to this product diversification strategy and the launch of standalone apps for food delivery? Perhaps so. In a recent report, Citi Research opined that incumbent online food delivery players must serve lower average order value (AOV) orders sustainably to increase the current growth rate.

“…new innovations like Bolt (<15min food delivery; shorter delivery radius, process flow interventions at restaurants), 99Stores, Snacc (micro-kitchens) could aid.”

Going by that, Swiggy’s newest initiative, Toing, perfectly fits in this strategy.

The worry, therefore, is not about its short-term growth prospects but rather about the sustainability of this growth in the long run. It has now been well established that the public market rewards profitable businesses. And Swiggy — net loss ballooning to INR 1,197 Cr in Q1 — is nowhere near profitability.

Swiggy Is Playing A Frequency Game, But At What Cost?While one may hope that its margin improvement in food delivery could aid in improving the fundamentals, as revenue also rises, we must not forget that this affordable and quicker food delivery comes at a cost, including operating the fleets, recruiting delivery executives, and giving discounts.

Inc42 also found that the same dish from the same restaurant in Pune cost lower on Toing compared to Swiggy’s flagship app. It is unclear how much Swiggy would lose per order to give this discount.

In every way, it looks difficult for the top-line growth to be reflected in its bottom line immediately.

Satish Meena, the founder of the data research platform, Datum Intelligence, pointed out that food delivery, as a category itself, is struggling to grow largely due to prices shooting up, and the fundamental habit of consumers in ordering food and eating out hasn’t changed. While it’s a little different with the younger cohort of customers, they are often restricted by spending limits.

“That’s why Zomato, Swiggy, and even Zepto have been trying to convert impulse buyers into customers with 10-minute delivery of samosas or other fast-food items. The second approach is to reduce the prices, as is evident with the new app, Toing.”

Meena, however, also noted that Swiggy could do the same on its main app without launching a new one, because it already has a pool of existing customers. In fact, Swiggy launched ‘99 Store’ just two months back with the same value proposition of serving price-conscious consumers.

“I think they launched a new app because they wanted to specifically highlight that food delivery is now available at an affordable price, while also increasing the total order volume via multiple platforms, said Meena. “How this is going to work to help in reaching profitability is yet to be seen,” he added.

Swiggy is possibly also trying to reduce the clutter on its main app, believes Hariprasad K, founder of wealth management platform Livelong Wealth. The new Toing app gives consumers a wider assortment of affordable meals compared to the 99 Store.

A separate app helps create a separate perception, too. We must note here that Swiggy’s own portfolio company, Rapido, has also forayed into food delivery with steep discounts compared to the two other incumbents.

Though Ownly is currently operational in parts of Bengaluru, the company has every resource (including its existing fleet) to scale up. Rapido is also banking on lower pricing to beat the incumbents.

“This is Swiggy’s frequency play. Affordable, repeat orders can boost customer stickiness and overall platform usage. And Swiggy shares rallied after the Toing app launch, as investors might have believed this app could catch the masses, given that it’s a budget-friendly delivery app. But when we examine the unit metrics or results of Swiggy, this app could only provide thin profit margins,” Hariprasad said.

Multiple Apps, But Same ConundrumEarlier this year, Swiggy investor Prosus publicly stated that the company’s growth last year came at the cost of profitability. Even in Q1, the $13 Bn company kept burning more than INR 1,000 Cr in cash.

And this is exactly the reason why many analysts are not confident about Swiggy. “At INR 100–INR 150 AOVs, margins are razor-thin. Swiggy must slash fulfillment costs, keep customer acquisition spend low, and improve contribution margins through partnerships or cross-sell opportunities,” added Hariprasad.

In fact, if Toing relies heavily on discounts, losses will deepen, which is again a red flag, as the company is also burning huge amounts of cash due to quick commerce investments.

Retail investors with a sharp thesis on margins and sustainability would do well to wait for Swiggy to show better unit economics and some evidence of narrowing losses. “For growth-oriented investors with a higher risk appetite, Toing could be an interesting speculative bet,” the Livelong Wealth founder added.

Even Jigar Patel, senior manager of equity research at Anand Rathi, suggests investors keep a ‘buy-on-dips’ approach with the Swiggy stock, even as he sees the stock rallying further till INR 495-INR 500 next week solely from a technical perspective.

“There is a resistance near the INR 515-INR 510 zone. I suggest keeping a stop loss near INR 445.”

While we have unpacked several aspects of Swiggy’s latest move, questions still linger around its multi-app strategy and where this path ultimately leads. Swiggy has not officially announced the launch of Toing yet. It also did not respond to Inc42’s query on the matter.

For now, the company seems committed to experimenting, as analysts expect both Swiggy and Zomato to double down on low-cost, quick food delivery over the next three to four quarters.

The bigger question remains: can Swiggy still deliver on its promises of profitability by June 2026?

Markets Watch: Upcoming Issues, Results & More- Urban Company’s Stellar Debut: The home services unicorn made a bumper debut this week on the bourses, listing at INR 161 on the BSE, 56.3% above the issue price

- DevX Makes A Muted Listing: The coworking space provider got listed at INR 61.3 on the BSE, marginally above its issue price

- Zappfresh Ready For Its SME IPO: The Meat delivery startup’s IPO subscription opens on September 26 at a set price band of INR 96 to INR 101 per share

- Groww Files Updated DRHP: After taking a confidential route initially, the investment tech major filed updated draft papers for an IPO, which will comprise fresh issue of shares worth up to INR 1,060 Cr and an OFS component of up to 57.4 Cr shares

- Nazara’s Bonus Issue: The gaming major has received shareholders’ nod to issue bonus equity shares in the ratio of 1:1 and for undertaking a stock split

The post Swiggy’s Unbundling Spree: Revisiting The Profitability Question appeared first on Inc42 Media.

You may also like

MAGA slams Angelina Jolie for 'I don't recognize my country' comment in Spain: 'We don't...either'

Poland's Donald Tusk warns country will shoot any Russian planes in its airspace

Essential items for new students revealed by graduates, including doorstops and earplugs

Super typhoon Ragasa batters northern Philippines

Viral destination is more than a summer escape - 'winter is the best time to go'